Building wealth has always been one of the central goals of investing, but the paths investors take can look very different. Some prefer the simplicity and broad market exposure of exchange-traded funds (ETFs), while others enjoy the thrill—and potential reward—of picking individual stocks.

This debate is not new. Ever since ETFs rose in popularity in the 1990s, investors around the world have asked: Is it better to own a diversified basket of securities, or to bet on single companies that could become the next Apple, Tesla, or Amazon?

The truth is, both strategies can create wealth. The real question is how they fit into your personal risk tolerance, time commitment, and long-term goals.

Let’s dive deeper into the strengths and weaknesses of each approach, along with strategies investors use globally to maximize returns.

Contents

- 1 What Exactly Are ETFs?

- 2 What Are Individual Stocks?

- 3 ETFs vs Individual Stocks: Detailed Comparison

- 4 Global Examples of ETFs

- 5 Global Examples of Individual Stocks

- 6 Wealth-Building with ETFs

- 7 Wealth-Building with Individual Stocks

- 8 Risk Management: ETFs vs Stocks

- 9 Tax and Cost Considerations

- 10 Which Strategy Is Better for Wealth Building?

- 11 FAQs

- 12 Related Posts

What Exactly Are ETFs?

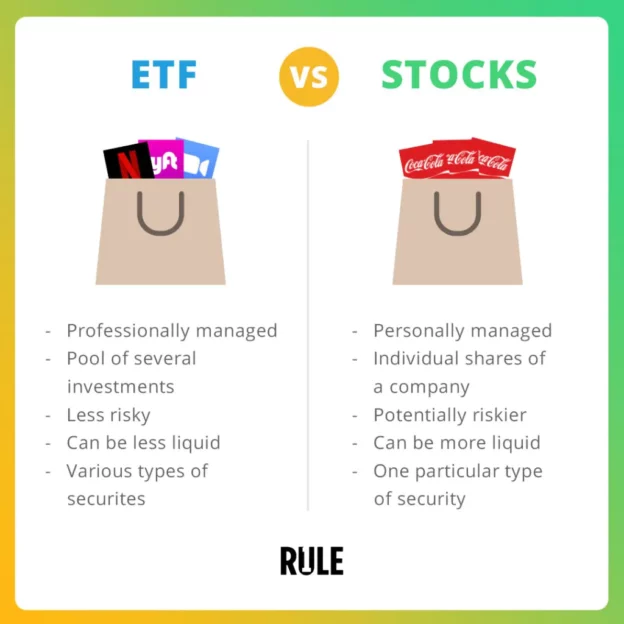

An ETF (Exchange-Traded Fund) is a financial instrument that bundles together a collection of assets—such as stocks, bonds, or commodities—and trades them on an exchange just like a stock.

Unlike mutual funds, which are priced once daily, ETFs can be bought or sold throughout the trading day at market prices. They are designed to track a specific index (such as the S&P 500 in the U.S., the FTSE 100 in the UK, or the Nikkei 225 in Japan) or to focus on a particular sector (technology, healthcare, energy, etc.).

Key advantages of ETFs:

-

Instant diversification across many holdings

-

Lower fees compared to mutual funds

-

High liquidity and flexibility

-

Tax efficiency in most jurisdictions

-

Accessible to both beginners and professionals

For investors who don’t want to choose individual companies, ETFs offer a “set-it-and-forget-it” solution.

What Are Individual Stocks?

Buying individual stocks means owning shares in a single company. When you buy Tesla, Microsoft, or Samsung, you directly participate in that company’s performance.

If the business grows, your investment can multiply many times over. But if the company underperforms, you may lose much or all of your capital. Unlike ETFs, there’s no diversification safety net.

Why investors choose stocks:

-

Potential for massive returns from the next market leader

-

Dividends provide income and compounding opportunities

-

Full control over portfolio construction

-

Ability to focus on companies and industries you understand

For active investors, stock picking is both an art and a science—part analysis, part intuition, and part patience.

ETFs vs Individual Stocks: Detailed Comparison

| Category | ETFs | Individual Stocks |

|---|---|---|

| Diversification | Spreads risk across dozens or hundreds of securities | Concentrates risk in one company |

| Risk Level | Generally lower, market-level volatility | Higher, depends on company performance |

| Return Potential | Moderate, mirrors index or sector | Unlimited upside, but also potential wipeout |

| Costs & Fees | Low expense ratios, usually under 0.25% | No ongoing fees, but trading costs apply |

| Research Needed | Minimal, passive investing style | High, requires analysis and monitoring |

| Time Commitment | Very low, suitable for hands-off investors | High, requires constant evaluation |

| Accessibility | Easy entry for beginners | Demands skill, knowledge, and discipline |

Global Examples of ETFs

-

SPDR S&P 500 ETF (SPY) – Tracks the largest 500 companies in the U.S.

-

Vanguard FTSE All-World ETF (VEU) – Offers exposure to developed and emerging markets.

-

iShares MSCI Emerging Markets ETF (EEM) – Focuses on high-growth economies like India, Brazil, and China.

-

Invesco QQQ Trust (QQQ) – Targets U.S. tech giants in the Nasdaq-100.

These ETFs allow global investors to participate in entire economies or industries with a single purchase.

Global Examples of Individual Stocks

-

Apple (AAPL) – The first company to reach a $3 trillion market cap.

-

Toyota (7203.T) – A global leader in automotive innovation.

-

Alibaba (BABA) – A major e-commerce and tech player in Asia.

-

Nestlé (NESN.SW) – A European multinational with a long dividend history.

Each represents a company that has changed industries and rewarded investors handsomely—if bought at the right time.

Wealth-Building with ETFs

-

Broad Market Exposure

Investing in world index ETFs (like Vanguard Total World Stock ETF, VT) gives you exposure to thousands of companies globally. -

Thematic Growth Investing

Sector ETFs let you tap into themes such as clean energy, AI, or healthcare innovation without betting on a single firm. -

Long-Term Compounding

Reinvesting ETF dividends accelerates growth over decades, making ETFs a favourite for retirement planning. -

Low Effort Strategy

ETFs are ideal for passive investors who prefer automation through robo-advisors or recurring contributions.

Wealth-Building with Individual Stocks

-

Finding Future Leaders

Investors who bought Amazon in the late 1990s or Tesla in 2012 turned small investments into fortunes. -

Dividend Growth Portfolios

Owning companies like Johnson & Johnson or Unilever provides not only dividends but also consistent appreciation. -

Concentrated Bets

High-conviction stock pickers can focus on a handful of businesses they deeply understand. -

Active Management

Active traders take advantage of short-term opportunities in earnings announcements, market news, and cycles.

Risk Management: ETFs vs Stocks

-

ETFs reduce risk by holding many securities, insulating you from catastrophic single-company losses.

-

Stocks magnify risk, where success depends on your ability to pick winners and avoid losers.

-

Market cycles affect both—ETFs fall in recessions too, but less violently than an individual company collapse.

-

Emotional investing is harder with stocks. Seeing a single company plunge can trigger panic selling.

Tax and Cost Considerations

-

ETFs: Investors globally benefit from relatively low costs and, in many countries, tax-efficient structures.

-

Stocks: Dividend taxation and capital gains vary across jurisdictions. Some countries (e.g., Singapore) don’t tax capital gains, while others (like the U.S.) do.

-

Fees: ETFs charge ongoing management fees, while stock investing costs mainly come from brokerage commissions.

Which Strategy Is Better for Wealth Building?

-

ETFs: Ideal for passive, long-term investors who want global diversification and consistent returns with minimal effort.

-

Stocks: Best for active investors who have the time, skill, and risk appetite to research and monitor their investments.

-

Balanced Approach: Many investors use ETFs as a stable foundation while allocating a smaller portion to individual stocks for growth opportunities.

FAQs

Q1: Which is more profitable, ETFs or stocks?

Stocks can be more profitable if you pick winners, but ETFs deliver steadier, long-term returns.

Q2: Do ETFs pay dividends like stocks?

Yes, many ETFs distribute dividends from their underlying companies.

Q3: Are ETFs risk-free?

No. ETFs reduce risk through diversification, but they still move with the broader market.

Q4: Should beginners start with ETFs or stocks?

ETFs are usually recommended for beginners due to their simplicity and lower risk.

Q5: Can I mix ETFs and stocks in one portfolio?

Absolutely. Many investors combine ETFs for stability and a few high-conviction stocks for growth.