When most people start investing in ETFs, they usually turn to broad market funds—like those that track the S&P 500 or MSCI World Index—to gain instant diversification.

While these are great foundations, they don’t allow investors to fine-tune exposure to industries that might outperform or provide defensive stability. That’s where sector ETFs come in.

A sector ETF focuses on a specific industry such as technology, energy, healthcare, or real estate. By investing in a sector ETF, you can target growth opportunities, hedge against inflation, or balance your portfolio with industries that tend to be more resilient in downturns.

In this article, we’ll explain how sector ETFs work, look closely at four key sectors, compare their past performance, and discuss how to use them effectively in a global investment strategy.

Contents

What Are Sector ETFs?

A sector ETF is an exchange-traded fund that holds companies within a particular segment of the economy. Instead of buying shares in dozens of companies individually, you can purchase one ETF and get exposure to the entire industry.

For example:

-

A Tech ETF might hold Apple, Microsoft, and Nvidia.

-

An Energy ETF could include ExxonMobil, Chevron, and BP.

-

A Healthcare ETF may own Johnson & Johnson, Pfizer, and biotech firms.

-

A Real Estate ETF often consists of REITs (Real Estate Investment Trusts).

These funds allow both beginners and experienced investors to gain precise exposure without overcomplicating their portfolio.

Why Consider Sector ETFs?

-

Targeted Growth Opportunities – Some industries outperform during certain market cycles (e.g., technology in bull markets).

-

Defensive Stability – Healthcare and utilities often perform well during downturns.

-

Inflation Hedge – Energy and real estate can provide protection against rising prices.

-

Portfolio Customization – Investors can overweight sectors they believe in while keeping broad exposure elsewhere.

-

Lower Research Burden – Instead of picking winners, sector ETFs give you the whole industry.

1. Technology Sector ETFs

Why Tech Matters

Technology has been the primary growth engine of global markets for decades. The rise of cloud computing, semiconductors, artificial intelligence (AI), and e-commerce has created companies with trillion-dollar valuations.

Popular Tech ETFs

-

Technology Select Sector SPDR Fund (XLK): Pure U.S. large-cap tech exposure.

-

Invesco QQQ Trust (QQQ): Tracks the Nasdaq-100, heavily weighted toward tech.

-

Global X Cloud Computing ETF (CLOU): Focuses on cloud infrastructure and SaaS.

Historical Performance

From 2010 to 2020, technology ETFs delivered some of the highest returns of any sector. For example, XLK grew more than 400% in that decade, outpacing the S&P 500’s ~200%.

Pros & Cons

✔ Strong long-term growth potential

✔ Innovation-driven companies

✘ Higher volatility during recessions

2. Energy Sector ETFs

Why Energy Matters

Energy powers the global economy. Oil and gas dominate today, but renewable energy is reshaping the sector. Energy ETFs often provide high dividends, making them appealing for income investors.

Popular Energy ETFs

-

Energy Select Sector SPDR Fund (XLE): Covers major U.S. energy companies.

-

iShares Global Energy ETF (IXC): Provides international energy exposure.

-

Invesco Solar ETF (TAN): Focuses on renewable energy, especially solar.

Historical Performance

The energy sector is cyclical. After struggling in the 2010s due to oil price crashes, energy stocks rebounded strongly in 2021–2022 when oil prices surged. XLE gained more than 50% in 2022 alone, outperforming most other sectors.

Pros & Cons

✔ High dividend yields

✔ Inflation hedge

✘ Highly sensitive to commodity prices and global politics

3. Healthcare Sector ETFs

Why Healthcare Matters

Healthcare is considered a defensive sector because people need medical services regardless of economic conditions. Aging populations worldwide and advances in biotech make this sector both stable and innovative.

Popular Healthcare ETFs

-

Health Care Select Sector SPDR Fund (XLV): Large U.S. healthcare companies.

-

iShares Biotechnology ETF (IBB): Focused on biotech growth.

-

Vanguard Health Care ETF (VHT): Broad U.S. healthcare exposure.

Historical Performance

Healthcare ETFs have consistently outperformed during downturns. For instance, during the COVID-19 market crash in 2020, healthcare declined less than the S&P 500 and rebounded faster due to vaccine and biotech demand.

Pros & Cons

✔ Defensive stability

✔ Long-term demographic tailwinds

✘ Regulatory risks (drug pricing, government policies)

4. Real Estate Sector ETFs

Why Real Estate Matters

Real estate ETFs typically hold REITs, which own and operate income-producing properties such as malls, offices, warehouses, and apartments. They are known for providing steady dividend income.

Popular Real Estate ETFs

-

Vanguard Real Estate ETF (VNQ): Broad U.S. REIT exposure.

-

Schwab U.S. REIT ETF (SCHH): Low-cost U.S. REIT exposure.

-

iShares Global REIT ETF (REET): International property diversification.

Historical Performance

Real estate has been a strong income generator, often yielding 3–5% annually in dividends. However, REITs are sensitive to interest rates—when borrowing costs rise, property values often decline.

Pros & Cons

✔ Reliable dividends

✔ Hedge against inflation

✘ Sensitive to interest rate hikes

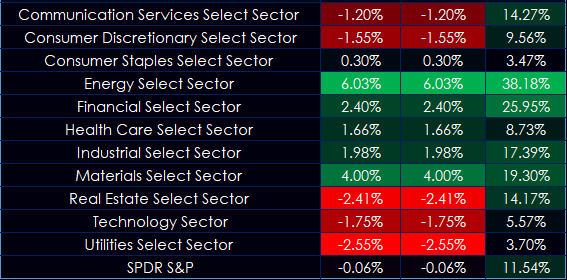

Case Study: Comparing Sector ETF Performance

Let’s compare how Tech vs. Energy vs. Healthcare vs. Real Estate ETFs performed from 2010–2022 (U.S. market data):

-

Tech (XLK): +400% growth (best long-term performer).

-

Energy (XLE): Flat to negative in 2010s, but surged in 2021–2022 (+50%).

-

Healthcare (XLV): +300% growth, steady performer across cycles.

-

Real Estate (VNQ): +150% growth plus consistent 3–5% dividend yield.

Takeaway: Technology leads long-term, healthcare offers stability, energy provides inflation hedging, and real estate delivers steady income.

Using Sector ETFs in a Portfolio

Strategy 1: Core + Satellite

-

Core: Broad market ETFs (e.g., S&P 500 or global ETF).

-

Satellite: 1–3 sector ETFs for growth or income.

Strategy 2: Cycle-Based Investing

-

Overweight energy during inflationary cycles.

-

Focus on healthcare and real estate in downturns.

-

Invest in tech during long bull markets.

Strategy 3: Income-Focused Portfolio

-

Use Real Estate (VNQ, REET) and Energy (XLE, IXC) for dividends.

-

Blend with Healthcare for stability.

Strategy 4: Global Diversification

-

Mix U.S. sector ETFs with international options for broader exposure.

Risks of Sector ETFs

-

Concentration Risk – Unlike broad ETFs, they are tied to one industry.

-

Economic Cyclicality – Sectors perform differently depending on global cycles.

-

Valuation Risks – Tech ETFs may become overvalued, while energy can collapse during oil crashes.

-

Policy and Regulation – Healthcare pricing or energy emissions policies can impact returns.

FAQs

Q1: Are sector ETFs riskier than broad ETFs?

Yes, they are more concentrated, which can mean higher gains but also sharper losses.

Q2: Can I build a portfolio with only sector ETFs?

It’s possible, but most investors use them to complement broad ETFs.

Q3: Do sector ETFs pay dividends?

Yes. Real estate and energy ETFs often pay higher dividends than tech ETFs.

Q4: Are there international sector ETFs?

Yes, many issuers offer global sector ETFs, such as iShares and SPDR.

Q5: How many sector ETFs should I own?

Most investors hold 1–3 sector ETFs in addition to a core market ETF.

Conclusion

Sector ETFs provide a way to target specific industries without the risk of picking individual stocks. Technology, energy, healthcare, and real estate are four of the most important sectors that shape economies worldwide.

Recommendations:

- Use sector ETFs as satellites, not as your whole portfolio.

- Balance growth and income—tech for innovation, healthcare for defense, energy and real estate for dividends.

- Pay attention to economic cycles when overweighting certain sectors.

- Keep an eye on fees and liquidity—stick with established funds.

- Always stay diversified to avoid being overexposed to one industry.

With the right mix, sector ETFs can enhance performance, provide stability, and align your investments with global economic trends.